Identifying Bearish FVGs: A Practical Guide

Fair Value Gaps (FVGs) represent areas on a price chart where no trading occurred, indicating a potential market imbalance. A bearish FVG is characterized by a significant price drop leaving a noticeable gap, suggesting weak buying interest and potentially foreshadowing further declines. Successfully identifying these gaps requires a keen eye and understanding of several key factors. Let's explore a step-by-step approach:

Spot the Gap: Locate a clear space on your price chart where the price abruptly drops, showing a significant absence of trading activity within that price range. The size of the gap can be indicative of the potential move's magnitude, but size alone isn't conclusive.

Confirm the Downward Trend: The price action following the gap should reinforce the bearish outlook. Observe lower lows and lower highs, confirming a downward trend. This step helps differentiate a true FVG from a temporary price fluctuation.

Analyze Gap Size and Significance: While larger gaps often signify stronger bearish momentum, consider the context. A large gap on a low-volume day may hold less weight than a smaller gap on a high-volume day. Volume analysis is crucial for assessing the significance of the detected gap.

Consider Timeframe: The chosen timeframe (daily, hourly, etc.) significantly impacts your interpretation. A bearish FVG on a daily chart may not be as significant on a 5-minute chart. Select a timeframe aligned with your trading style and risk tolerance.

Getting Confirmation: Beyond the Gap

Identifying a potential bearish FVG is just the beginning. Confirmation is crucial before entering a trade. Several signals can significantly improve trade accuracy. It’s essential to avoid false signals. What can we expect to see?

Volume Analysis: Low volume during gap formation suggests a lack of conviction behind the price drop. Conversely, increased volume after the gap strongly indicates renewed selling pressure, confirming the bearish trend. High volume during the price drop and low volume during the gap are strong confirmation signals.

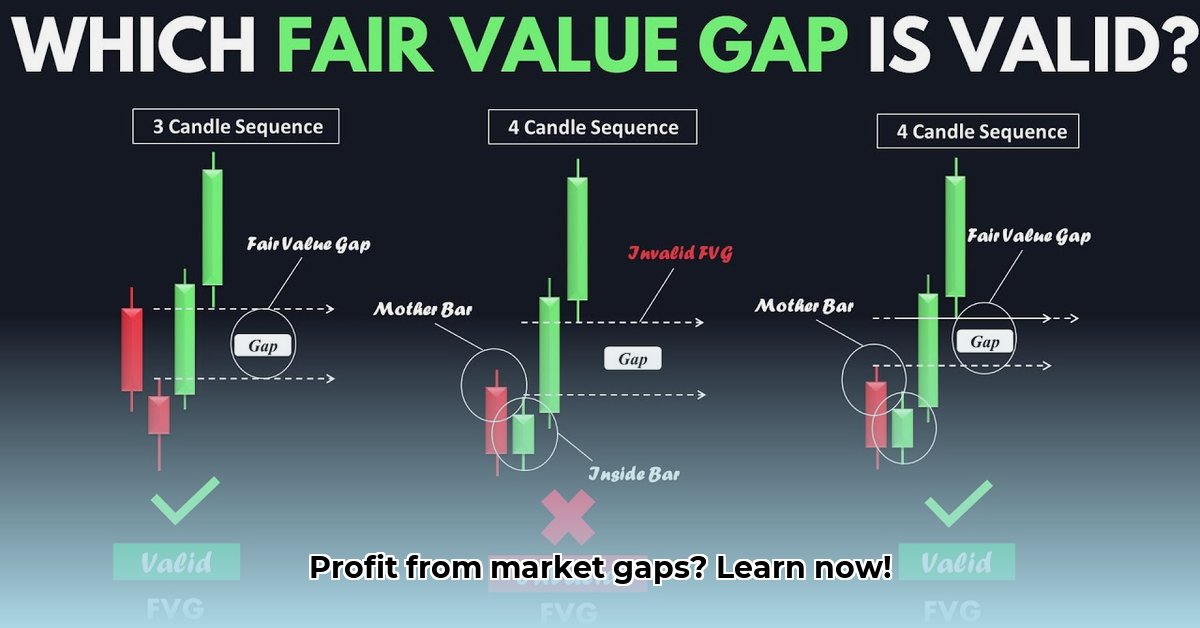

Price Action Patterns: Bearish candlestick patterns like engulfing patterns (a large candle completely encompassing the previous one) or bearish harami (a small candle within a larger one) provide visual cues reinforcing the downward trend.

Indicator Support: Technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) offer additional confirmation. Bearish divergence (price makes higher highs while the RSI makes lower highs) indicates weakening upward momentum, strengthening the bearish signal.

Risk Management: Protecting Your Capital

Trading inherently involves risk. Effective risk management is paramount, especially when working with potentially volatile market gaps. What safeguards should you put in place?

Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your total trading capital on a single trade. This limits potential losses, even if the trade moves against your expectation.

Stop-Loss Orders: Always set a stop-loss order just above the gap's high. This automatically limits losses if the price unexpectedly reverses. The stop-loss acts as a safety net, preventing catastrophic losses.

Strategic Exits: Consider using trailing stop-losses, which adjust your stop-loss price as the price moves favorably, securing profits. Alternative exit strategies help optimize profits and manage risk effectively. Don't be emotionally attached to any single trade.

Trading Strategies with Bearish FVGs: A Practical Approach

Let's outline specific entry and exit strategies employing bearish FVGs:

Entry Strategy: Avoid immediate entry. Wait for a slight price retracement within the gap before entering a short position (betting on a price decline). This pullback offers a potentially improved risk-reward ratio. This is a prudent strategy to avoid false signals.

Exit Strategy: Predetermine your profit target before entering. Close your short position when the price reaches the target. Maintain your stop-loss order throughout the trade.

Illustrative Example: Imagine a stock shows a sharp drop, creating a substantial gap. After a small retracement within the gap, you enter a short position. Your stop-loss is positioned just above the gap's high. Your profit target is the bottom of the FVG or a slightly less aggressive level.

Backtesting and Refinement: Continuous Improvement

Rigorous backtesting of your strategy on past market data is crucial. This process reveals flaws and allows optimization of your entry and exit criteria. The financial markets are dynamic, so continuous refinement is essential for long-term success in this area.

Advanced Techniques (Optional)

Experienced traders might integrate other technical tools, like advanced indicators or algorithmic trading, to enhance their bearish FVG strategies. However, significant expertise is required for these advanced techniques.

Conclusion: Mastering the Bearish FVG Strategy

Successfully profiting from bearish FVGs requires a methodical approach that combines precise identification, confirmation signals, and stringent risk management. Remember that trading always entails risk; the key is to mitigate that risk through informed decisions and a disciplined approach. Consistent backtesting and continuous learning are vital in refining your strategy and achieving long-term success. The information provided here is for educational purposes and does not constitute financial advice. Always conduct independent research before making trading decisions.